When you are in a business-to-business (B2B) or business-to-government (B2G) industry, you can take advantage of Interchange Optimization. Due to the high occurrence of business, corporate, and purchasing cards involved with handling payments in the B2B and B2G industries, there are ways to ensure you are paying the best possible Interchange rate on these card types.

What is Interchange Optimization?

Interchange Optimization relates to how your business processes the credit cards you accept for payment for the goods and services you sell. Some card types allow extra data to be passed and qualify the transaction on a lower Interchange rate based on the additional data provided. The data you should pass for the best rates at your company is called Level II and Level III data. Level II data include basic transactional information including PO numbers, destination address information, tax, and the requestor name. Level III data gets into more itemized information that includes Item ID/SKU, item description, unit price, extended price, unit amounts, commodity code, and line discounts.

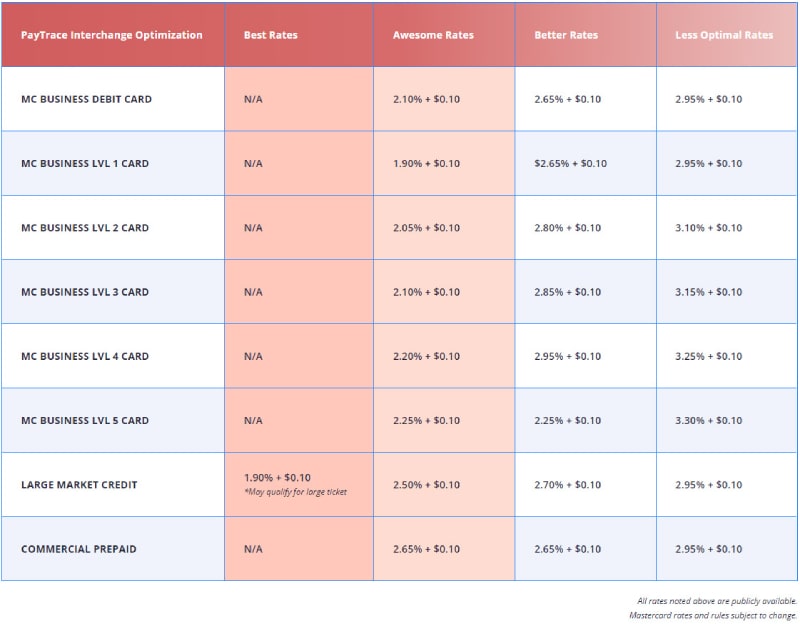

Great, we know how cards can qualify for lower processing costs based on additional data. The savings vary from card to card, based on how much information gets provided to the card brand issuer. You probably wonder, “How much can this additional data save my business?” Well, let’s look. Below are examples of first MasterCard-branded cards, then Visa-branded cards.

Here is a chart showing some MasterCard Interchange Optimization.

Next, take a look at the Visa savings available with Interchange Optimization.

By looking at your statements, you can easily see if your company is reaping the benefits of Interchange Optimization. If you find your processing cost on the right side of the scale for the cards mentioned above, you could lower your overall cost significantly. Great job, if you find your rates are already on the left side of the chart!

Feel free to contact Total Merchant Services for more information on how we can help you optimize your processing to qualify for the bests rates available. Our system is an omnichannel platform so that you can integrate the solution everywhere you accept payments. Call us (1-800-518-6825) to learn more today.